Beef Label Claims and Their Effects on Purchasing Behavior

Insights on beef label claims and associated consumer behavior provided by National Cattlemen’s Beef Association (NCBA), a contractor to the Beef Checkoff.

March 2024

Beef is a popular and essential source of protein worldwide. It is consumed in many forms, from steaks and roasts to ground beef and jerky. With its nutritional value and versatility, beef has become a staple in the diets of many people around the world. However, in recent years, there has been increasing interest in exactly what you are buying when you pick up that steak or order that burger. Label claims have become a key factor in the purchasing decisions of many consumers and a way for retail and foodservice operators to differentiate their products.

Regardless of choice, the beef industry continues to enjoy strong consumer demand. According to the Beef Checkoff’s Consumer Beef Tracker, 70% of consumers ate beef at least weekly throughout the 2023 calendar year. ¹ Some label claims appeal to customers more than others. For instance, we know consumers are most apt to purchase items that indicate USDA (United States Department of Agriculture) grade, while breed specific claims garner the least amount of attention.1 This article will discuss some of these production claims and analyze the demand surrounding them, but before we move on, let’s examine some of the most common label claims and what they actually mean.

What Are Label Claims?

Label claims are statements made on food packaging that describe the product's attributes or qualities. For beef, these claims can be about the product's nutritional value, how the cattle were raised, quality factors, and what medications were utilized during the animal's life. Some of the common label claims for beef include:

Grass-Finished: Grass-finished cattle spend their entire lives grazing and eating from pastures. These cattle may also eat forage, hay, or silage at the feedyard. As well, grass finished cattle may or may not be given FDA-approved antibiotics to treat, prevent or control disease and/or growth-promoting hormones.

Grain-finished: Grain-finished cattle, like grass finished, spend most of their lives eating grass and foraging in pastures. When beef is grain-finished, cattle are free to eat a balanced diet of grain, local feed ingredients, like potato hulls or sugar beets, and hay or forage at the feedyard. Similarly, grain-finished cattle may or may not be given FDA-approved antibiotics to treat, prevent or control disease and/or growth-promoting hormones.

Certified Organic: Certified organic beef, designated by the official label, comes from cattle that have never received any antibiotics or growth-promoting hormones. These cattle may be spending time at the feedyard and can be either grass-finished or grain-finished if the USDA’s Agriculture Marketing Service certifies the feed as 100% organically grown.

Naturally Raised: Naturally raised beef comes from cattle that have never received antibiotics or growth-promoting hormones. This beef may spend time at a feedyard and can be either grain-finished or grass-finished.

Hormone-free: Beef raised without growth hormones. Antibiotic-free: Beef raised without antibiotics. Grade: Select, choice, and prime are the most common grades which are based on tenderness, juiciness, and flavor.

Breed Specific: Refers to the animal's breed the product came from, such as Angus, Hereford, and Wagyu. These label claims provide information to consumers about the product they are purchasing and can influence their buying decisions.

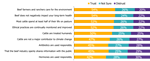

Figure 1

Beef Labeling - Intentionally Purchased in Past Month

SOURCE: Consumer Beef Tracker, 2018 - 2023. Analyzed by National Cattlemen’s Beef Association, on behalf of the Beef Checkoff.

The Impact of Label Claims on Beef Sales

Label claims can have a significant impact on beef sales. Consumers are becoming more aware of the impact their food choices have on their health, the environment, and animal welfare. They are willing to pay a premium for products that meet their criteria for quality, sustainability, and ethical production. Quality attributes like USDA grade are the most effective claim when driving higher sales. The grade is followed by callouts about how the animal was raised and then its breed. Furthermore, 77% of consumers have intentionally made a purchase decision based on a label callout.1

Consumers are also willing to pay more for certain claims over others, providing operators an opportunity to increase sales. When it comes to ground beef, consumers are willing to pay $1.61 to $1.90 more per pound for labels such as “USDA Prime” or “Breed Specific” versus standard “ground beef” when comparing the five-year average.1

This also applies to steak which commands a much higher price point than ground beef. Consumers are willing to pay $7.11 to $7.85 more for steak labels such as “USDA Prime” or “Breed Specific” when comparing the five-year average willingness to pay.1

Figure 2

Beef Labeling: Willingness to Pay - Ribeye Steak

SOURCE: Consumer Beef Tracker, 2018 - 2023. Analyzed by National Cattlemen’s Beef Association, on behalf of the Beef Checkoff.

Beef Grading

The grade of beef is still the most influential claim when it comes to overall sales. In 2023, 40% of consumers actively sought out beef that was graded as choice, the highest percentage of any claim.1 This claim also resonates differently between generations with Boomers paying the most attention to grade and Gen Z’s paying the least amount of attention. However, over time grade has decreased in importance falling from a high of 46% in 2019.1 Organic, local & humanely raised have seen the most consistent increase since 2019, but still fall short of grade or a label of grass-fed.1

Figure 3

Label Claims Purchased in the Past Month - USDA Choice

SOURCE: Consumer Beef Tracker, 2018 - 2023. Analyzed by National Cattlemen’s Beef Association, on behalf of the Beef Checkoff.

Production Claims

While the grade of beef has the most impact on consumer purchase decisions, production claims also come into play for a smaller portion of consumers. Labels such as "grass-fed," "organic," and "humanely raised" not only signify certain production practices but also serve as trust signals for consumers seeking transparency in the food supply chain. In an era where individuals are increasingly conscious of the environmental impact of their choices and the ethical treatment of animals, these production claims have increased over time as decision making factors.1

Grass-finished, or grass-fed as it’s more commonly called, has the most significance over all the other production claims over the past five years.1 This presents an opportunity for retailers and restauranteurs to educate their consumers that all cattle feed on grass for most of their lives and are only fed grain during the last 3 – 6 months before processing. The difference will produce distinctly different flavor and tenderness profiles that may or may not appeal to individual consumers.

Grass-finished may be the production claim that resonates the most with consumers, but it’s important to know that the largest increase in over the past five years pertains to the label of organic.1 Similarly, the most consistent year-over-year increase for a label belongs to the claim of humanely raised especially with Gen Zs and Millennials.1

Figure 4

Label Claims Purchased in the Past Month - Raised Humanely

SOURCE: Consumer Beef Tracker, 2018 - 2023. Analyzed by National Cattlemen’s Beef Association, on behalf of the Beef Checkoff.

Consumer Knowledge, Concerns, and Trust

While purchasing behavior and data is important to understanding label claim impacts, it’s equally important to understand the mindset of the consumers as it pertains to production knowledge and trust in raising cattle. This allows operators to fill in the gaps to better market and sell beef products.

In a recent survey only 28% of consumers claim to know a lot about how cattle are raised and 43% often or always consider how food was raised when making purchases.1 When asked what concerns they have regarding how cattle are raised, animal welfare ranks the highest at 22% with hormones and antibiotic usage coming in at 2nd and 3rd with 16% and 14% respectively.1 This makes sense given the consistent rise of the claim ‘humanely raised’ illustrated above.

Trust also plays a pivotal role in consumer decision making when it comes to beef. While over 70% of people surveyed report trusting that beef is nutritious and safe to eat, that percentage drops significantly to 42 – 45% when they consider the use of antibiotics and hormones, as well as transparency of the beef industry.1

Figure 5

Trust Metrics: How Cattle Are Raised for Food (Part Two)

SOURCE: Consumer Beef Tracker, 2018 - 2023. Analyzed by National Cattlemen’s Beef Association, on behalf of the Beef Checkoff.

Conclusion

While beef sold with a production claim label represents a small percentage of total beef sold, consumers do have options to choose beef products that carry production-based claims. The beef industry has shown that it is willing to adapt and provide the choices some consumers are looking for, and this production related claim data is evidence of that.

Conventional beef is still the overwhelming favorite at the meat department; however, production claim-based products are expected to continue to be part of the many choices consumers have either at the grocery store or their favorite restaurant.

Sources:

- Consumer Beef Tracker Survey, Directions Research, 2018 - 2023. Analyzed and summarized by National Cattlemen’s Beef Association, a contractor to the Beef Checkoff.